Loan Temporary Buydowns

A temporary mortgage interest rate buydown allows borrowers to reduce their effective monthly loan payment for a limited period of time through a temporary buydown of the mortgage interest rate.

In a temporary buydown of mortgage interest rate, the effective loan interest rate that a borrower pays during the early years of the mortgage is reduced as a result of the deposit of a lump sum of money (sometimes called a “subsidy”) into a buydown account, a portion of which is released each month to reduce the borrower’s payments. The buydown funds may be provided by various parties, including the borrower, the lender, the borrower’s the property seller, employer, or other interested parties to the transaction.

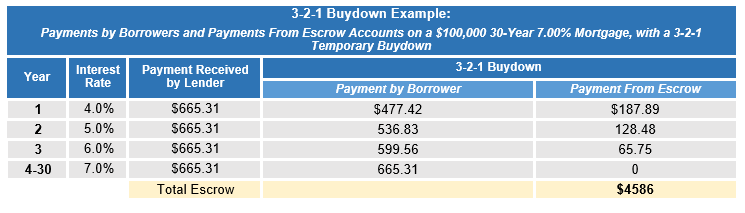

A common temporary mortgage interest buydown include a “3-2-1” “2-1”. “1-0”. For example, a “3-2-1” buydowns means the mortgage payment in years one, two, and three is calculated at rates of 3 percent, 2 percent, and 1 percent, respectively, below the note rate on the loan. The actual note rate and monthly mortgage payment that the borrower is obligated to pay is never actually reduced, and the full note rate and mortgage loan payment must be reflected on the mortgage documents. At the end of the temporary interest rate buydown period, the rate buydown funds collected at closing will have been exhausted, and the loan buydown period ends. Here is the Temporary Buydown Example: